Published On Nov 8, 2023

LLC vs. S-Corp Comparison by a Trusted CPA

My name is Sherman the CPA and I specialize in tax planning for businesses with over $100,000 in income at mycpacoach.com.

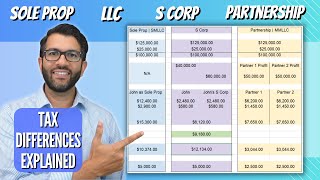

I am fresh off of finishing a tax plan for a client that saved them $20,000 in taxes from converting to an S-Corp, so today I want to walk you through some of the benefits of an S-corp versus an LLC.

When I work with my clients, one of the very first things I look at is their entity structure to determine if they are operating in the most tax-efficient manner.

And oftentimes, they are either an LLC or Sole Proprietor thinking about becoming an S-Corporation or C-Corporation.

And based on their unique set of circumstances, I will help them choose the best entity to operate from.

So today, I want to provide you with some valuable information based on my experience to help you navigate through this.

If you watch this video until the end, you will learn:

What is an S-Corp?

The benefits of an S-Corp vs an LLC

Some major drawbacks of an S-Corp

When it makes sense to elect S-Corp Status vs. an LLC

Subscribe: https://bit.ly/2HJlq46

Please be sure to give this video a like and subscribe to our channel so you don't miss out on future videos!

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).