Published On Nov 17, 2023

Description:

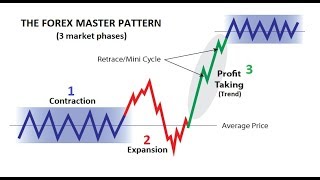

Dive into the complex world of trading with this enlightening level three tutorial, focusing on market rigging and how to avoid falling victim to it. Learn about the hidden scripts run by banks, the significance of Black Swan events, and how to become an astute observer of the market game. This comprehensive guide offers a profound understanding of the mechanisms behind market manipulation and strategies to safeguard your trading approach.

Key Takeaways:

- Black Swan Events and Market Impact (0:00 - 1:25): Understand what Black Swan events are, their rarity, and the massive impact they have on traditional trading models.

- Rigged Markets and Bank Strategies (1:38 - 4:07): Explore how major banks and institutions rig the market for profit, utilizing their understanding of liquidity and traders' pain points.

- Analyzing a Black Swan Event (4:01 - 5:01): Study a real-life example of how a Black Swan event like the 2011 tsunami in Japan can disrupt market norms but eventually return to regular trading patterns.

- Recognizing and Responding to Market Manipulation (5:35 - 6:01): Learn how to identify signs of market manipulation and adjust your trading strategy accordingly.

- Questions to Guide Your Trading (6:57 - 7:58): Utilize strategic questions to maintain a neutral perspective and align with the most probable market movements.

This lesson is a must-watch for traders aiming to navigate the often-rigged waters of the market with more confidence and understanding. For more insights into advanced trading concepts, visit www.tradeats.com.

---

Chapters:

0:00 Introduction to Black Swan Events

1:38 How Markets are Rigged

4:01 Example of a Black Swan Event in Trading

5:35 Understanding Market Manipulation

6:57 Questions to Enhance Trading Strategy

7:58 Conclusion and Key Takeaways

---

Hit the bell icon to stay updated on our latest uploads!