Published On Premiered Oct 15, 2021

Wondering when to cash-out refinance a rental property? If so, you’re not alone. Homeowners and real estate investors are seeing a huge uptick in home equity all while interest rates are the lowest they’ve been in decades. So, as an intelligent investor, should you keep the equity in your rental property or use a cash-out refinance to open up more investment opportunities and potentially close on more units.

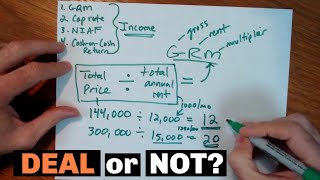

Dave Meyer, VP of Data and Analytics and a man with a fascination for meat surrounded by two pieces of bread, has some simple calculations that can answer your cash-out conundrum. Firstly, you’ll need to calculate your equity in a rental property, from there, you can calculate your return on equity (ROE for short), and finally, you can work out whether or not a cash-out refi would increase this ROE. If so, it may be time for you to contact your lender and get a refinance set up!

Did you enjoy the whiteboard-style calculations in this video? If so, let us know in the comments below and we’ll be sure to do more!

~~~~

Join BiggerPockets for FREE 👇

https://www.biggerpockets.com/signup

~~~~

Check out Last Week’s Episode on Short-Term Rentals:

• Now is THE Best Time to Buy a Short-T...

~~~~

Cash Out Refinances vs HELOCs | Which Should You Use?

https://www.biggerpockets.com/blog/ro...

~~~~

5 Reasons to Utilize Your Equity & How to Safely Invest It:

https://www.biggerpockets.com/blog/5-...

~~~~

Do Today’s Record-Low Rates Make Refinancing a Winning Strategy?

https://www.biggerpockets.com/blog/re...

~~~~

Follow Dave on Instagram:

@thedatadeli or / thedatadeli

00:00 An Unprecedented Time for Home Equity

01:17 Should You Refinance?

02:41 #1 Calculating Equity

05:19 #2 Calculating Return on Equity (ROE)

07:38 Selling vs. Cash-Out Refinancing

08:08 #3 Calculating ROE After a Refi

11:31 Own a Rental? DO THIS NOW!