Published On Nov 25, 2023

Business Inquiries: [email protected]

Well Built Wealth: https://www.wellbuiltwealth.ca/

Links:

Planning software we use: Conquest https://www.conquestplanning.com/en-c...

Withholding tax article: https://www.moneysense.ca/columns/ask...

RRIF Withdrawal Rates: https://www.sunlife.ca/en/investments...

Tax Calculator: https://wowa.ca/calculators/income-tax

-------------

------

Intro (0:00)

#1 - No Retirement Plan (0:17)

#2 - Paying Ridiculous Fees (2:35)

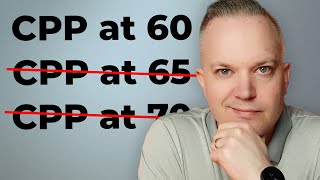

#3 - Paying More Tax Than Necessary (3:58)

#4 - Not Adjusting Spending Habits (6:23)

#5 - Forgetting to Plan for Annual Taxes (7:08)

#6 - Giving Too Much to Adult Children (8:38)

#7 - Retiring Too Late (10:03)

#8 - Not Enjoying the "Go-Go" Phase (11:08)

#9 - Not Planning for Health Expenses (12:16)

#10 - Underestimating Inflation (13:26)

------

DISCLAIMER: All videos on this channel (including this one) are for educational or entertainment purposes only. They are not (and are not intended to be) financial, investment or legal advice. It is our firm position that everyone has a unique situation and should seek professional advice on how best to navigate it. Rhys Martell is a Chartered Investment Manager (CIM), a Fellow of the Canadian Securities Industry (FCSI), a Qualified Associate Financial Planner (QAFP) and more. However, he is not registered to provide investment advice and, therefore, does not provide specific investment recommendations. Those looking for specific investment advice should seek out a registered professional.