Published On Apr 21, 2022

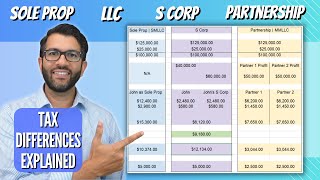

What's the difference between an LLC vs S Corp vs C Corp? And which one should you pick? Well, today I am going to cover in great detail the best business entity structure for you in 2022.

Subscribe: https://bit.ly/2HJlq46

Tax Services: https://bit.ly/3iC6FCI

Invest in Real Estate with Fundrise: https://bit.ly/3diNU4D

Timestamps

Intro (0:00)

What is a Business Entity? (1:30)

Choosing the best Business Structure is Important (3:20)

Entity #1 (4:29)

Entity #2 (7:02)

Entity #3 (9:08)

Entity #4 (10:20)

Entity #5 (12:35)

Entity #6 (14:25)

How to Choose the Best Business Structure (15:30)

Bonus Tip (18:06)

More Popular Uploads:

Disadvantages of an LLC: • Disadvantages of LLC: Don't Believe A...

Tax Benefits of a C Corporation: • Tax Benefits of a C Corporation: Bett...

How to Use a Business Credit Card: • How to Use a Business Credit Card for...

7 Popular Tax Write-Offs That Could Trigger an IRS Audit: • 7 Popular Tax Write Offs That Could T...

How to File Your Taxes as an LLC: • How to File Your Taxes as a LLC Owner...

How to Start a Business: • How to Start a Business in 2024: Your...

I'll cover:

- Why choosing the right business entity is important

- An overview of the 4 types and subtypes of business structures

- & Simplify which one may be better for you based on your goals

My goal is to help make sure you start a business with a legal structure that suits your needs, or you reconsider which entity you have already selected. Because each one has its pros and cons, there are amazing LLC tax benefits, S corp tax benefits, and C corp tax benefits.

Hey, I'm Sean with lyfe accounting. The accounting company that helps you save on taxes and build more wealth. Please be sure to give this video a like and subscribe to our channel so you don't miss out on future videos!

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).