Published On Premiered Feb 17, 2021

One of the most popular types of business entities in the United States is a single-member limited liability company. That is why it is so important to us to make a video about Single Member LLCs in 2023 this tax season.

Book a Tax Services Discovery Call: https://schedule.lyfetaxes.com/discov...

This type of LLC has only one owner. A single-member LLC is usually a business registered in the state where the company does business.

The phrase “single-member” is an admission that the LLC has one owner, and that owner is referred to as a member.

A single-member LLC has so many benefits that are shared with other LLCs.

So in this video, I’m going to break down some of those advantages and disadvantages of a single member llc in 2023.

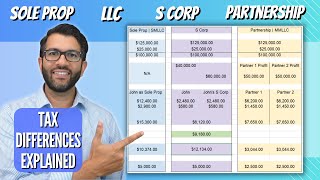

While also discussing a typical operating agreement, how taxes work and compare it against sole proprietorship.

Let’s first dive in by quickly looking at what an LLC is.

LLC stands for limited liability company which is simply a type of business entity you can create when you choose to go into business.

Examples of other entities would be sole proprietorship, limited partnerships, general partnerships, S corporations and C corporations.

All these business entities have their own unique advantages and disadvantages.

Want to learn more about LLCs? Watch our LLC playlist: • The Best Business Entity to Save on T...

More Popular Videos:

9 Business Ideas that Never Fail: • 9 Business Ideas that Never Fail? Hig...

How to Start a Business: • How to Start a Business in 2024: Your...

5 Grants to Start a Small Business: • 5 Grants to Start a Small Business (f...

Tax Planning for Beginners: • How to Build a Tax Plan (Tax Planning...

Tax Secrets: • Tax Secrets: What “They" Don’t Want Y...

///

Disclaimer: The information provided in this video is for entertainment purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).