Published On May 18, 2019

FREE PRICE PATTERN GUIDE: http://getpricepatterns.com/

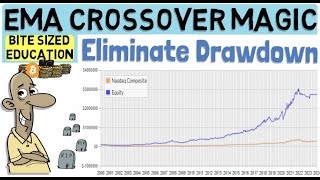

The three moving average crossover strategy (3 EMA) is an approach to trading that uses 3 exponential moving averages of various lengths. This is an EMA trading strategy that can be used in any market and time frame.

All moving averages are lagging indicators however when used correctly, can help frame the market for a trader. You can see how MA's can give you information about market states by looking at the Alligator trading strategy that I posted a while ago.Using moving averages, instead of buying and selling at any location on the chart, can have traders zoning in on a particular chart location.From there, traders can use various simple price action patterns to decide on a trading opportunity.

- See more at: https://www.netpicks.com/three-moving...

Download the free indicator blueprint: http://gettheblueprints.com/

Candlestick Reversals: http://getcandlesticks.com/ FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. NetPicks Services are offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized investment advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer: https://www.netpicks.com/risk-disclosure