Published On May 7, 2021

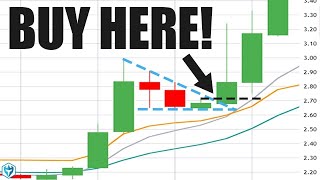

This basic stochastic rsi trading strategy can be used on any time frame and any forex currency pair or asset that you trade. The Stochastic RSI (StochRSI) is an indicator used in technical analysis that ranges between zero and one (or zero and 100 on some charting platforms) and is created by applying the Stochastic oscillator formula to a set of relative strength index (RSI) values rather than to standard price data. Using RSI values within the Stochastic formula gives traders an idea of whether the current RSI value is overbought or oversold.

The trading floor is a new project that I just launched.

World class day trading education and tools

https://www.trdfloor.com/welcome

FunderPro

Start your funded account challenge HERE (20% discount with link)

https://funderpro.com/get-funded-with...

my twitter / artybryja

For charts Use Trading View

https://www.tradingview.com/?aff_id=1...

New Official Telegram Group

TMA OFFICIAL®

https://t.me/TMAbyArty

Looking for a forex broker?

I use Osprey

https://ospreyfx.com/tradewithtma

regulated broker i recommend is Blueberry markets

https://bit.ly/blueberrytma

Try a $100,000 funded account from OspreyFX

https://ospreyfx.com/tradewithtma

Use coupon code

movingaverage50

To get $50 off

Sign up for a $100,000 FTMO funded account here

https://trader.ftmo.com/?affiliates=i...

Get a free audio book from audible

https://tmafocus.com/2WyXSqa

Links to the indicators

TMA Overlay

https://www.tradingview.com/script/zX...

TMA Divergence indicator

https://tmafocus.com/3nfcEfd

TMA shop

https://shop.spreadshirt.com/themovin...

Get some free stocks from WEBULL

https://tmafocus.com/3p0vatP

also

Get some free stocks from Public

https://tmafocus.com/3GUUojh

Trading Platform

META TRADER 4

#stochastic #rsi #daytrading

The StochRSI oscillator was developed to take advantage of both momentum indicators in order to create a more sensitive indicator that is attuned to a specific security's historical performance rather than a generalized analysis of price change.

The StochRSI was developed by Tushar S. Chande and Stanley Kroll and detailed in their book "The New Technical Trader," first published in 1994. While technical indicators already existed to show overbought and oversold levels, the two developed StochRSI to improve sensitivity and generate a greater number of signals than traditional indicators could do.

The StochRSI deems something to be oversold when the value drops below 0.20, meaning the RSI value is trading at the lower end of its predefined range, and that the short-term direction of the underlying security may be nearing a low a possible move higher. Conversely, a reading above 0.80 suggests the RSI may be reaching extreme highs and could be used to signal a pullback in the underlying security.

Along with identifying overbought/oversold conditions, the StochRSI can be used to identify short-term trends by looking at it in the context of an oscillator with a centerline at 0.50. When the StochRSI is above 0.50, the security may be seen as trending higher and vice versa when it's below 0.50.

The StochRSI should also be used in conjunction with other technical indicators or chart patterns to maximize effectiveness, especially given the high number of signals that it generates.

In addition, non-momentum oscillators like the accumulation distribution line may be particularly helpful because they don't overlap in terms of functionality and provide insights from a different perspective.

NOT FINANCIAL ADVICE DISCLAIMER

The information contained here and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor, nor am I holding myself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided here and the resources available for download are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial professional to address your particular information. The Company expressly recommends that you seek advice from a professional.