Published On Jan 26, 2023

Brought to you by Protekt’s REST sleep supplement https://protekt.com/tim, Athletic Greens’s AG1 all-in-one nutritional supplement http://athleticgreens.com/tim, and Shopify global commerce platform providing tools to start, grow, market, and manage a retail business http://shopify.com/tim

Resources from this episode: https://tim.blog/2023/01/25/bill-gurley/

Bill Gurley (@bgurley) has spent more than 20 years as a general partner at Benchmark. Before entering the venture capital business, Bill spent four years on Wall Street as a top-ranked research analyst, including three years at Credit Suisse First Boston.

Bill also maintains a blog on the evolution and economics of high-technology businesses called Above the Crowd.

Over his venture career, he has worked with such companies as GrubHub, Nextdoor, OpenTable, Stitch Fix, Uber, and Zillow.

Bill has a BS in computer science from the University of Florida and an MBA from the University of Texas. He is also a chartered financial analyst. Bill is a board trustee at the Santa Fe Institute, a research and education center focused on the study and understanding of complex adaptive systems.

Please enjoy!

00:00 Start

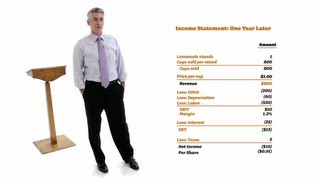

01:19 The book Bill calls “the most efficient short-form MBA one can find.”

03:03 Sell-side analysts vs. buy-side analysts.

05:20 Financial models, rules of thumb, and making (sometimes wrong) decisions.

13:34 Howard Marks and Stan Druckenmiller.

15:42 Micro vs. macro investing.

16:57 Institutional Investor’s All-America Research Team.

21:00 Expanding distribution.

24:07 Return On Invested Capital (ROIC).

30:30 Repurposing good ideas for alternative applications.

34:40 The conviction of network effects.

36:42 SaaS and open source.

38:51 Bet sizing.

40:21 Equal partnership over hierarchy.

46:54 Lessons learned from partners.

49:58 Recommended resources.

55:56 Problems open source can solve.

1:07:05 Building a better network with the interest graph.

1:11:36 Dissecting Bill’s Twitter thread about risks and sudden valuation resets.

1:22:06 The Metaverse.

1:27:30 Revenue and earnings quality matter.

1:29:41 Undervalued competitive advantages.

1:33:52 Jeff Bezos: corporate mad scientist?

1:40:21 The counterintuitive condemnation of company camaraderie.

1:45:06 Tobi Lütke.

1:48:34 Books Bill has gifted frequently.

1:52:17 The Santa Fe Institute.

1:54:35 Bill’s board.

1:56:46 Cultivating anti-tribalism.

1:58:36 Twitter: what is it good for?

2:02:05 Newsletters and other resources Bill relies on.

2:03:44 Bill’s book in progress.

2:04:56 Regulatory capture.

2:10:04 Predicting what America will look like in 10-20 years.

2:11:48 Parting thoughts.

Tim Ferriss is one of Fast Company’s “Most Innovative Business People” and an early-stage tech investor/advisor in Uber, Facebook, Twitter, Shopify, Duolingo, Alibaba, and 50+ other companies. He is also the author of five #1 New York Times and Wall Street Journal bestsellers: The 4-Hour Workweek, The 4-Hour Body, The 4-Hour Chef, Tools of Titans and Tribe of Mentors. The Observer and other media have named him “the Oprah of audio” due to the influence of his podcast, The Tim Ferriss Show, which has exceeded 900 million downloads and been selected for “Best of Apple Podcasts” three years running.

Sign up for "5-Bullet Friday" (Tim's free weekly email newsletter): https://go.tim.blog/5-bullet-friday-yt/

Follow the Tim Ferriss Podcast: https://tim.blog/podcast/

Visit the Tim Ferriss Blog: https://tim.blog/

Follow Tim Ferriss on Twitter: / tferriss

Follow Tim Ferriss on Instagram: / timferriss

Like Tim Ferriss on Facebook: / timferriss