Published On Sep 5, 2022

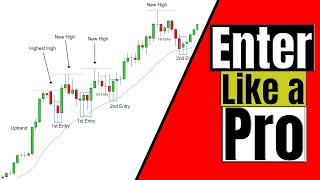

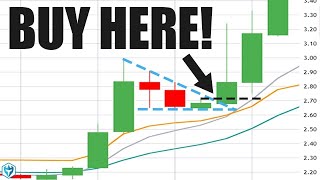

In trading traders buy low and sell high. In order for traders to not buy high or sell low, they need to wait for the correction of prices. The goal of a trader is to identify when the correction ended and when will the trend resume. The Two Legged Pullback under the right conditions helps traders to identify when is the time to enter the market.

Price action describes the characteristics of a security’s price movements. This movement is quite often analyzed with respect to price changes in the recent past. In simple terms, price action is a trading technique that allows a trader to read the market and make subjective trading decisions based on the recent and actual price movements, rather than relying solely on technical indicators.

Instagram - / realthomaswade

Twitter - / iamthomaswade

Facebook - / wadetradingacademy

Price Action Rules

1) Trendline Rule

2) Don‘t Counter Trend Trade

3) Trading Range Rule

4) High Probability Setup Rule

5) Signal Bar Rule

The only people who know where the market is heading are institutions. They are the ones who make the market move and our job as retail traders is to follow their footsteps and get the piece of their movement. As price action traders we need to find the most profitable ways to enter trades. The highest probability setups are 2nd entries at the key entry points.

If you want more advanced Trading tips, strategies and trading community.

https://wadetradingacademy.com/

Looking for a funding company? Try

https://apextraderfunding.com/member/...

Use Coupon Code for 80% discount! - RXBKISKT