Published On Apr 19, 2022

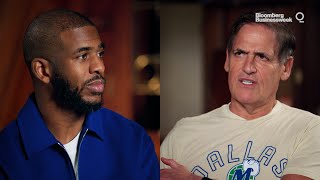

Inflation fears, broken supply chains and conflict in Ukraine have tech valuations tightening and IPOs on hold. But given their recent records, that won’t slow down these investors on the 21st annual Midas List of the world’s leading venture capitalists for long.

Produced in partnership with TrueBridge Capital Partners, the Midas List is the definitive ranking of the top 100 tech investors. At number one for the first time is Andreessen Horowitz partner Chris Dixon, the two-time entrepreneur turned crypto investment king, who jumped six slots thanks to his firm's continued investments in crypto exchange Coinbase and a portfolio including decentralized exchange Uniswap and NBA Top Shot creator Dapper Labs. He is one of 12 Midas List members who bet on Coinbase, but he’s the only one to make sure his firm did it 15times – across every funding round from its Series B in 2013 to its April 2021 IPO.

That company and other public offerings, such as those for Coupang and HashiCorp, and soaring valuations for companies like Airtable, Databricks and Nubank help propel 15 newcomers onto this year’s list. Another nine who previously dropped off the list return to this year’s ranks. Micky Malka, a Venezuelan-born crypto and fintech specialist, checks in this year at No. 2, while newcomers Neil Mehta and David Frankel crack the top 20. And a record 12 investors from Europe, Israel and the Middle East appear on the 2022 list, up from eight the year before. They include newcomer Reshma Sohoni of Seedcamp, one of 11 women on this year’s list – one shy of last year’s record, and a reminder of the VC industry’s continued need for change.

To qualify, investors are ranked by their portfolio companies that have gone public or been acquired for at least $200 million over the past five years, or that have at least doubled their private valuation since initial investment to $400 million or more over the same period. Forbes and TrueBridge put a premium on liquid exits over unrealized returns, as well as large multiples on money invested for early-stage investors or large sums of cash returned for growth-stage specialists. (Or for top Midas investors: both.) A data-driven list, the Midas List is produced from a combination of public data sources and the submissions of hundreds of investment partners across dozens of firms each year.

Read the full list on Forbes: https://www.forbes.com/midas/

Subscribe to FORBES: https://www.youtube.com/user/Forbes?s...

Stay Connected

Forbes newsletters: https://newsletters.editorial.forbes.com

Forbes on Facebook: http://fb.com/forbes

Forbes Video on Twitter: / forbes

Forbes Video on Instagram: / forbes

More From Forbes: http://forbes.com

Forbes covers the intersection of entrepreneurship, wealth, technology, business and lifestyle with a focus on people and success.