Published On Apr 3, 2023

Subscribe to our YouTube channel: / @teachmepersonalfinance2169

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! https://www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: https://www.teachmepersonalfinance.co...

Here are links to articles and videos we've created to address forms and schedules mentioned in this video or the accompanying article:

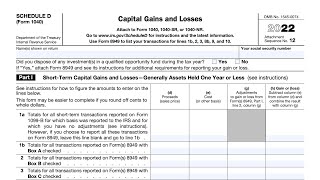

IRS Schedule D, Capital Gains and Losses

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule D Walkthrough (Capital G...

Use Form 8995 to figure your qualified business income (QBI) deduction. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of their net QBI from a trade or business, including income from a pass-through entity, but not from a C corporation, plus 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. However, your total QBI deduction is limited to 20% of your taxable income, calculated before the QBI deduction, minus net capital gain.

Individuals and eligible estates and trusts that have QBI use Form 8995 to figure the QBI deduction if:

-You have QBI, qualified REIT dividends, or qualified PTP income or loss (all defined later); and

-Your 2022 taxable income before your QBI deduction is less than or equal to $170,050 if single, married filing separately, head of household, qualifying surviving spouse, or are a trust or estate, or $340,100 if married filing jointly; and

-You aren’t a patron in a specified agricultural or horticultural cooperative.

Otherwise, use Form 8995-A, Qualified Business Income Deduction, to figure your QBI deduction.